When making seasonal adjustments for world refined production and usage, September showed a production surplus of about 25,000 t. The refined copper balance for the first nine months of 2016, including revisions to data previously presented, indicates a production deficit of around 84,000 t (and a seasonally adjusted deficit of about 29,000 t). This compares with a production deficit of around 28,000 t (a seasonally adjusted surplus of about 34,000 t) for the same period of 2015.

In the first nine months of 2016, world apparent refined usage is estimated to have increased by around 3% (565,000 t) compared with that in the same period of 2015 mainly due to Chinese apparent demand as world usage excluding China remained essentially unchanged. Chinese apparent demand increased by around 7% in the first nine months of 2016 based on a 2% increase in net imports of refined copper and 7% growth in refined production. However, net refined copper imports have been on a declining trend in 2016 with the monthly average in the third quarter 40% below that of the 1st half. Monthly average Chinese apparent demand in the 3rd quarter 2016 is 5% below that in the first half. In the first nine months of 2016 aggregated usage in the EU, Japan and the United States is down by 0.6%. On a regional basis, usage is estimated to have increased by 1% in Europe and 5% in Asia (when excluding China, Asia usage increased by 2%), while declining by 11.5% and 4% in Africa and in the Americas respectively and remaining essentially unchanged in Oceania.

World mine production is estimated to have increased by around 6% (820,000 t) in the first nine months of 2016 compared with production in the same period of 2015. Concentrate production increased by 7.5% while solvent extraction-electrowinning (SX-EW) declined by 0.5%. The increase in world mine production was mainly due to a 44% (+530,000 t) rise in Peruvian output that is benefitting from new and expanded capacity brought on stream in the last two years. A recovery in production levels in Canada, Indonesia and the United States, and expanded capacity in Mexico, also contributed to world growth. However overall growth was partially offset by a 4% decline in production in Chile, the world’s biggest copper mine producer, and a 7% decline in DRC where output is being constrained by temporary production cuts. On a regional basis, production rose by 7% in the Americas, 9% in Asia and 7% in Oceania but declined by 4% in Africa while remaining essentially unchanged in Europe. The average world mine capacity utilization rate for the first nine months of 2016 increased to 86% from 85% in the same period of 2015.

World refined production is estimated to have increased by about 3% (510,000 t) in the first nine months of 2016 compared with refined production in the same period of 2015: primary production was up by 2.5% and secondary production (from scrap) was up by 5.5%. The main contributor to growth was China (+7%), followed by the United States where production increased by 13% and Mexico (+19%) where expanded SX-EW capacity is contributing to refined production growth. Output in Chile and Japan, the second and third leading refined copper producers, increased by around 1% and 3% respectively. Refined production in the DRC and Zambia declined due to the impact of temporary production cuts. On a regional basis, refined output is estimated to have increased in the Americas (5%), Asia (6%) and Oceania (8%) while declining in Africa (-13%) and in Europe (-3.5%). The average world refinery capacity utilization rate for the first nine months of 2016 remains practically unchanged from that in the same period of 2015 at around 83.5%.

Based on the average of stock estimates provided by independent consultants, China’s bonded stocks increased by around 70,000 t in the first nine months of 2016 from the year-end 2015 level. Stocks decreased by around 130,000 t in the same period of 2015. In the first nine months of 2016, the world refined copper balance adjusted for the change in Chinese bonded stocks indicates a production deficit of around 16,000 t compared to a deficit of about 155,000 t in the same period of 2015.

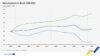

The average LME cash price for November was US$5,443.25 per tonne, up from the October average of US$4,732.14 per tonne. The 2016 high and low copper prices through the end of November were US$5,935.50 (on 28th Nov) and US$4,310.50 per tonne (on 15th Jan), respectively, and the year-to-date average was US$4,793.60 per tonne (13% below 2015 annual average). As of the end of November, copper stocks held at the major metal exchanges (LME, COMEX, SHFE) totalled 451,780 t, a decline of 30,088 t (-6%) from stocks held at the end of December 2015. Compared with the December 2015 levels, stocks were down at SHFE and up at the LME and COMEX.