There are three main reasons why the country has gone from being an exporting to becoming an importing country, says Country Manager for Geminor in Finland, Ismo Hiltunen.

As long as Geminor’s subsidiary Gemifin OY has existed, the Finish market has only been an exporting market. Ever since 2011, the company has annually exported between 100,000 and 150,000 tonnes of waste for material or energy recovery to Central Europe.

Now this trend has reversed, says Ismo Hiltunen, Country Manager for Geminor in Finland. “During the last couple of years, the Finnish market has changed radically, and we are now seeing a growing demand for waste fractions. The reduced volumes of waste in Finland have put an end to waste export, and this is a situation that probably will last for the foreseeable future,” says Hiltunen.

Three main reasons

There are mainly three reasons why the waste market is changing in Finland, explains Hiltunen.

“Less residual waste in the Finnish market has to do with the increased political focus on the sorting of waste. Finland has become a leading country in the EU regarding material recycling of food waste, plastic, and paper. From the summer of 2023, there will also be stricter requirements for the sorting of plastics, which will have an impact on residual volumes”, says Hiltunen. He also points to lower economic activity being the reason for the decline of national waste volumes in Finland.

Another reason is the war in Ukraine. Russia and Belarus are now banned from the Finnish market, which is particularly noticeable because Finland has greater economic ties to Russia than most countries in Europe. “An example is the import of wood from Russia, which is now a closed chapter. In addition, imports of coal, oil, and gas have stopped, bringing the energy market out of balance. This increases the importance of energy production from residual waste,” says Hiltunen.

Increasing incineration capacity

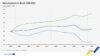

A third reason for the turning of the Finish market is that Finnish municipalities have increased their national WtE incineration capacity considerably in the last couple of years. This year, the capacity for waste to energy recovery is around 2.2 million tonnes, which is a growth of 10 percent in a short time.

“Two larger district heating and WtE plants have recently been built and expanded in Finland. Luonavoima in Salo outside the city of Turku was built in 2021 and has a capacity of 120,000 tonnes. In addition, Vantaan Energia, which supplies the Helsinki area with district heating, has increased its WtE capacity by 200,000 tonnes. Several other WtE plants have moved from incinerating Russian biochips to using SRF. As a result, both SRF and RDF have become in demand in Finland, but the national market cannot supply enough,” says Hiltunen.

Plastic is important in the “new” market

Significant changes normally introduce new challenges. But for Geminor, it’s all about planning well and thinking long-term.

“We believe that waste plastic for mechanical and chemical recycling will become more important in Finland in the future, and this is something we want to focus on,” says Hiltunen.

“At present we operate two HUBs in Finland where we supply SRF both for WtE-plants and for cement production. In the time to come, we will concentrate on securing tailor-made fuel for the Finnish plants. A very important factor in the present market is to have international access to the right fractions. At the same time, entering new surplus markets in Europe will make a big difference in supplying Finland with much-needed waste for energy recovery,” concludes Hiltunen.