However, supply chains are not regional, but global. Therefore, corresponding measures also have an impact on other countries. In the “Impacts of EU Circular Economy Policies in Third Countries” study, Eunomia was commissioned by the European Environmental Bureau to examine the possible effects on Vietnam and Nigeria.

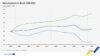

With the Circular Economy Action Plan, the European Commission has presented an ambitious concept to advance the circular economy in order to achieve climate neutrality by 2050, to decouple resource consumption from economic growth and to secure the EU‘s competitiveness in the long term. This also includes promoting global transformation efforts. However, so far it is unclear as to how these ambitions affect third countries outside the EU. Part of the circular approach is to act holistically at all levels of the supply chain – both inside and outside the EU. Moreover, such an approach will lead to numerous changes in the supply chain and can thus influence third countries environmentally, socially, economically and politically – both positively and negatively. The report therefore examined the vehicle and electronics industries. The focus is on the potential impact of the corresponding EU directives in these sectors. Specifically, Vietnam and Nigeria were examined, firstly because of their activities in these value chains and secondly because of their trade relations with the EU. While Vietnam mainly exports to the EU, Nigeria is an importing country for EU products. Due to the strength of the EU internal market and the high demand for materials and products, circular economy measures can have a cascading effect on external markets. Companies need to adapt to EU regulations to compete in the European market. However, EU measures that undermine certain sectors of the economy or reinforce inequalities in third countries can also reduce support for circular economy measures abroad. Since the signing of a Free Trade Agreement and an Investment Protection Agreement in 2019, trade between the EU and Vietnam has increased. These agreements have lifted nearly all trade barriers between the two partners. In the first half of 2022, the trade surplus with Vietnam increased by nearly 40 per cent compared to the same period last year. In 2021, Vietnam‘s share of EU imports was 1.8 per cent, making it the EU’s 11th largest trading partner in terms of imports.

Recently, the government in Vietnam has taken numerous measures to improve its ESG performance. The aim is not only to make the country attractive for investors through high environmental and social standards, there is also a self-interest in reducing the country‘s environmental impact. Electronics is an important export industry for Vietnam. Samsung is the largest foreign investor, and companies such as Apple are relocating large parts of their production to Vietnam due to the poor state of US-Chinese relations. Of the top twenty products Vietnam exports to the EU, seven fall into the electronics category. For Vietnam, Europe is the second-largest export market for electronics. One third of the country‘s phones are exported to the EU. Vietnam‘s major contribution to the automotive industry is the production of rubber for the manufacture of tyres and other vehicle parts. The country is the world‘s third-largest rubber producer, with a market share of 10 per cent. Vietnam‘s automotive industry is also expanding significantly. Large investments are being made in the production of batteries for electric vehicles. The EU‘s new design directive will force companies to make changes in product design. How this will affect Vietnam depends on how manufacturers deal with it. It is possible that other suppliers will be needed. Due to the strict information requirements, it is possible that manufacturers will abandon smaller suppliers in particular. This is because the administrative burden will also increase with the implementation of the directive. On the other hand, there is also a growth opportunity for Vietnam‘s electronics industry if the companies can comply with the new requirements. By adopting the ecodesign principles, companies could also improve their resource efficiency and thus reduce costs. As far as the battery industry is concerned, the EU requirements can still be met at this early stage of development. In addition, Vietnam has nickel reserves that will be mined in the future, which could become important for the export of batteries. The requirements to provide a Digital Product Passport could be a disadvantage for small suppliers in Vietnam and could lead to a loss of jobs. On the other hand, the growth opportunities in electronics, battery production and nickel mining could create new jobs. All these measures would lead to environmental improvements.

African countries currently trade more with the EU than within the continent. For Nigeria, the EU is the largest trading partner. Due to their historically close economic relations, this is not likely to change. This includes the export of electronic equipment from the EU to Nigeria – both legally and illegally. The recycling of e-waste is hardly regulated in Nigeria. Therefore, the material is often dumped in residential areas and processed informally. It is often set alight to remove plastics and recover metals, releasing toxic chemicals into the air and contaminating drinking water. Accordingly, there is a lack of health and safety standards. The first laws have been passed to change this – but with little success so far. Nigeria is also the largest African importer of used cars. Officially, 400,000 vehicles are imported annually, but many are smuggled into the country illegally as well. Changes in taxes and customs duties, however, could reduce the demand for used vehicles. The import of vehicles older than 12 years is already prohibited. The EU‘s circular economy policy could reduce the quantities of e-waste, end-of-life vehicles and batteries for the recycling industry in Nigeria – for both the formal and the informal sectors, which could also have an impact on jobs. However, more new jobs are expected to be created than old ones lost. There would also be an opportunity to transfer more people from the informal to the formal sector, improving their working conditions. Restrictions on the export of hazardous waste from the EU would also reduce environmental impacts.

[…] Source link […]