Plastic converting companies all over Europe report difficulties in getting the necessary raw materials to keep their production running, and alarmingly low stocks.

Demand for polymers had recovered in Europe in the second half of 2020 after a strong drop in production due to the COVID-19 pandemic and the corresponding lockdown measures. But while plastics converters began to re-increase their production, the supply of raw material did not grow accordingly.

“Since December 2020, the situation worsened rapidly. Additionally, extreme weather conditions in the USA lead to production losses also affecting the European market. In addition, European producers have also been declaring increased numbers of Force Majeure cases in the past months, as the Polymers for Europe Alliance reported already in January”, explains EuPC Managing Director Alexandre Dangis.

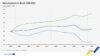

The situation is further aggravated by shortages in shipping containers. As a result of all this together, prices for polymers have risen sharply, reaching record-high levels, limiting credit facilities as a consequence, and dramatically reducing the very tight small margins of converting companies.

“There are about 50,000 small to medium plastic converter companies in Europe, which have to face the raw material shortages and significant price increases without any leverage in the negotiations with multinational polymer producers,” says EuPC President Renato Zelcher. “If the situation continues like this, more and more companies will have to reduce their production, leading in return to shortages of plastic products such as food packaging or parts for the construction or automotive industry.”

EuPC calls upon its partners in the European polymer manufacturing industry to work together with their European customers to try and resolve this difficult situation as soon as possible in order not to put supplies of essential goods in danger.