However, in 2023, global macroeconomic headwinds including recessionary fears became a real test for companies’ sustainability commitments.

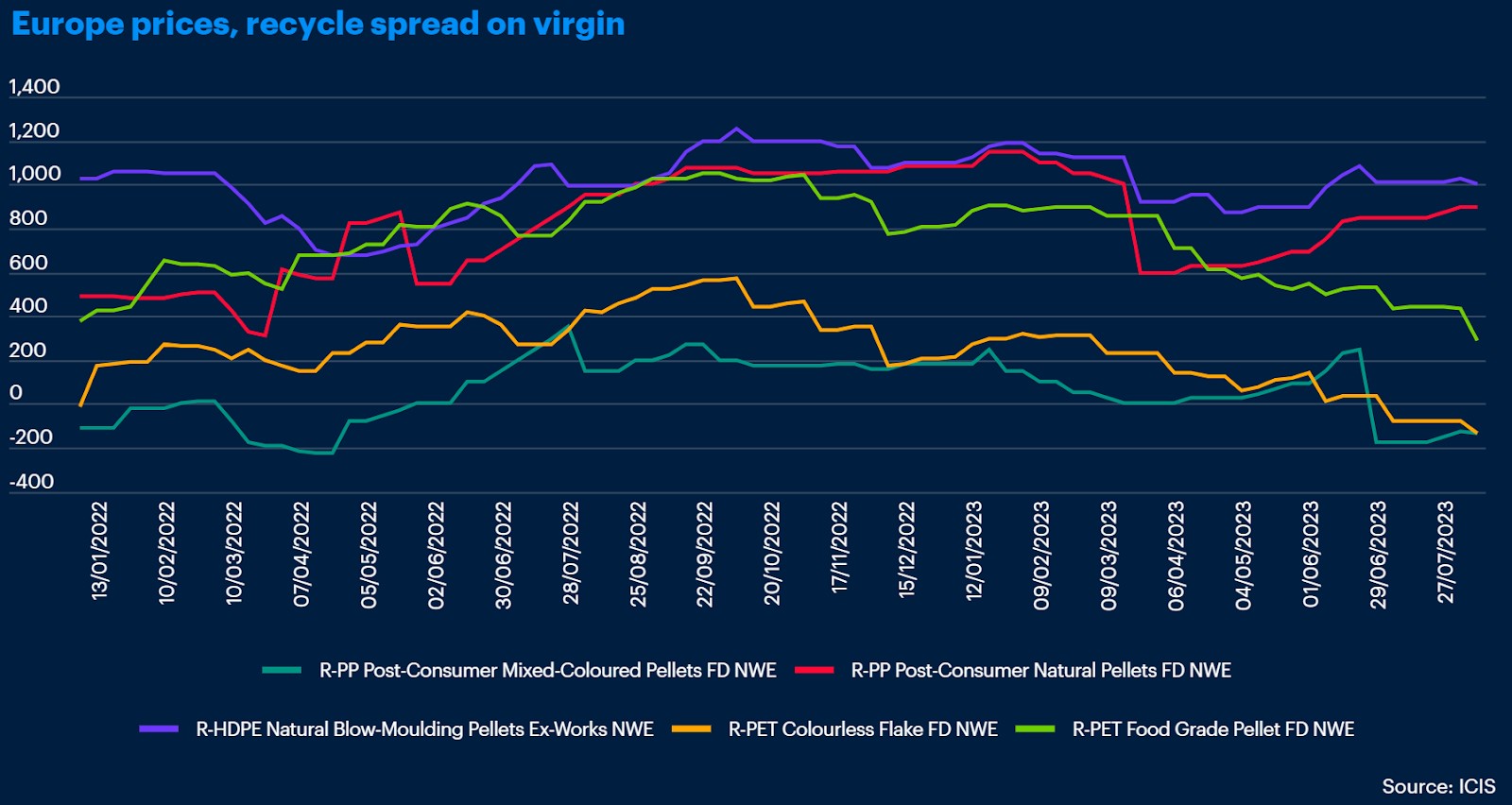

Overall low polymer demand across the key end-use industries with subsequent drops in virgin prices over 2023 made some companies (particularly those less exposed to consumer or regulation pressure) switch to low-cost feedstock alternatives. In the first half of 2023, this was virgin material. As a result, the existing record high prices for recycled polymers began to decline as well. While this may seem like a positive development as more brand owners might access more cost competitive recycled polymers, the long-term affect is likely to be adverse – disincentivising much-needed investments into building sorting and recycling capacity.

The current global mechanical recycling penetration rates (recycled polymer production divided by total polymer consumption) across the major commodities, such as polyethylene terephthalate (PET), polyethylene (PE) and polypropylene (PP), sits within 5-15%, according to the ICIS Supply & Demand Database and ICIS Recycling Supply Tracker – Mechanical. Despite a challenging 2023, production of mechanically recycled polymers is forecast to witness relatively strong growth supported by continuing consumer pressure, voluntary pledges and new legislation across the globe.

However, if the current market trends continue and no major acceleration happens, ICIS does not expect those global mechanical recycling penetration rates to exceed 20% by 2050. The main reasons include not only the overall growth of polymer consumption, but also the existence of certain plastic applications, which are intrinsically challenging to be recycled mechanically (for example, flexibles or textiles) as well as stringent requirements for contact-sensitive applications (for example, food-grade recycled polyolefins).

Chemical recycling has a wide potential to complement mechanical recycling by addressing the above-mentioned challenges. However, despite an overall cautiously optimistic outlook for its future, chemical recycling faces its own battles, including uncertain regulatory status around the world, the necessity to adopt mass-balance models for calculating recycled content, relatively high CAPEX and low consumer awareness.

According to the ICIS Recycling Supply Tracker – Chemical, the total installed (input) chemical recycling and dissolution capacity operating globally as of November 2023 is around 1.5m tonnes/year and, based on the final investment decision (FID) projects, this global capacity is expected to reach around 4m tonnes/year in the next five years. However, the pre-FID project pipeline is much larger with more than 6m tonnes/year just awaiting a green light from those companies.

The main question then becomes what should be done to unlock this pre-FID potential as well as to widen the project pipeline further. Although there is no silver bullet to achieve this, creating a certain macro environment for implementing those investments should be the first step, including the following measures:

- creating incentives for long-term demand for recycled polymers, for example, through adopting recycled content mandates

- providing economic support to infrastructure development, for example, through implementing extended producer responsibility (EPR) schemes

- embracing the best practices and innovations in collection and sorting, for example, through using high-tech (watermarks and artificial intelligence (AI)) and building complex integrated recycling centres

- recognising the legislative status of chemical recycling and a mass balance chain of custody model

- pro-actively engaging with consumers and promoting awareness about benefits of deploying all the recycling technologies available.